Two automobile collision reports register in the claims platform within the same hour. Each submission contains driver statements, police report numbers, photographs of rear bumper damage, and repair estimates formatted in similar templates. A claims intake specialist verifies policy numbers against the underwriting database and confirms active coverage on the reported dates of loss. Claim numbers generate automatically, followed by timestamps recorded in the activity log. Status fields turn from “New” to “Open,” and both files are assigned to the same regional auto unit.

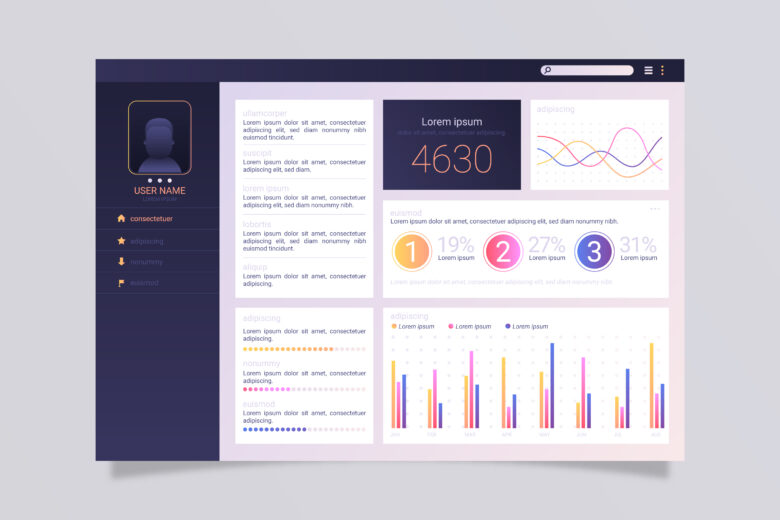

The internal dashboard displays identical reserve amounts calculated from standardized valuation tables. Liability indicators are marked “Undisputed” in both cases. Template acknowledgment letters queue for dispatch. The system interface presents the two files in adjacent rows, sorted by date and time of receipt. Early movement appears uniform, reflected in matching progress markers across the screen.

Dashboards

Midday processing shifts the files to adjuster dashboards. Each adjuster views a grid of open claims, color-coded by status and monetary exposure. The two collision files sit within the same financial band, beneath the adjuster’s authority threshold. Notes fields contain brief summaries referencing minor damage and clear liability.

A vendor portal upload modifies one file. The repair facility submits a supplemental estimate after removing the damaged bumper. The additional line item references recalibration of a proximity sensor embedded in the vehicle’s safety system. The updated total crosses the adjuster’s settlement authority band by a narrow margin. The claims platform immediately applies a routing rule. A notification appears in the file’s header reading “Supervisor Approval Required.” The claim leaves the adjuster’s queue and enters a supervisory approval list.

The second collision claim remains under the threshold. Its workflow advances directly to payment preparation. A payment request is generated and sent to the accounting module. The adjuster closes the evaluation tab, and the claim status changes to “Payment Pending.” The two files now occupy separate internal queues, though outward communications remain identical in format.

Vendor Portals

In the property unit, two water damage claims involving burst pipes are processed on the same day. Intake documentation includes moisture readings, photographs of damaged drywall, and contractor estimates. Both files receive initial approval for drying equipment and minor repairs. The vendor portal displays identical line items for removal of baseboards and flooring replacement.

An environmental field appears in the property inspection report for one file. The inspector checks a box labeled “Mold Presence Confirmed.” The act of selecting that field activates an environmental compliance workflow embedded in the claims management system. The file transfers to an environmental review queue, visible only to specialists within that team. A new document request appears in the activity log, referencing laboratory testing results and remediation plans.

The second property claim lacks any mold indicator. It remains within the standard property damage queue. Payment authorization for repair costs proceeds without the environmental routing tag. The document index for this file remains concise, listing initial estimates and inspection reports only.

Compliance Screens

A compliance unit monitors claims through a separate interface displaying regulatory alerts. A policy memo archived in the system carries an effective date marking a change in documentation requirements for certain bodily injury claims. One open injury claim falls within the new classification. The compliance screen displays an alert icon next to the file number. An internal note references the updated memo version and requests attachment of a revised disclosure form.

Another injury claim with comparable initial documentation closed before the memo’s effective date. The compliance interface lists no alert for that file. The version history of the policy form accessed during evaluation reflects an earlier edition stored in the document archive. The system retains both versions in its database, each associated with a specific date range.

Compliance alerts remain visible in the claim summary panel until documentation is uploaded and verified. The activity log records each compliance-related action with timestamps and user identifiers.

Audit Modules

A quality assurance script runs at the end of the month, selecting a sample of closed claims for internal audit. One of the auto collision files appears in the audit module. Its status changes from “Closed” to “Audit Review.” The audit interface opens a checklist requiring verification of settlement authority adherence, documentation completeness, and policy interpretation accuracy. An audit analyst enters comments in a dedicated field linked to the file.

The second collision claim does not appear in the sampling batch. Its closed status remains unchanged in the primary dashboard. The audit module displays no entry for that file. The sampling algorithm operates independently of claim similarity or financial value.

Audit activity is logged separately from standard claim processing notes. Each audit interaction adds a layer to the file’s history, visible in the audit tab but not in the outward claim correspondence record.

Fraud Indicators

A fraud analytics engine evaluates open claims continuously. Data fields from each file are compared against historical patterns stored in the insurer’s central database. One homeowner claim triggers a flag due to a prior loss history entry connected to the same property. The system generates an “SIU Referral” status and routes the file to the special investigation unit’s restricted-access queue.

The activity log reflects the referral event with a timestamp and routing code. Access permissions for the file shift, limiting visibility to authorized personnel. Additional entries referencing recorded statements and third-party verifications appear in the investigation tab.

A parallel homeowner claim without such data markers continues within the property unit’s standard processing queue. Its activity log contains no investigation entries. Both claims originated from similar incidents, yet their internal routing paths diverge once the fraud flag activates.

Escalation Logs

A customer service representative logs a formal complaint for one injury claim after a dispute regarding settlement valuation. The complaint triggers a regulatory tracking module within the claims platform. An escalation log opens, displaying response deadlines, supervisory review checkpoints, and a separate case identifier tied to the original claim number.

Internal correspondence drafts circulate through a compliance review queue before release. The escalation module records each draft submission and approval with timestamps. The injury claim remains open while the complaint process unfolds.

Another injury claim from the same period closes without any escalation entry. Its file contains no regulatory tracking module link. The escalation log exists as a distinct layer within the system, activated by specific communication events.

Supervisory Queues

Supervisory approval queues update throughout the day as claims exceed predefined financial thresholds. Files in these queues display authority band data and proposed settlement figures. Supervisors review documentation within a dedicated approval screen and apply electronic signatures to authorize payment release.

The collision claim involving sensor recalibration remains in this queue until supervisory approval is granted. Once approved, the file returns to the adjuster’s dashboard for final payment processing. The routing history tab shows each transfer between adjuster and supervisor, complete with time and date stamps.

The companion collision claim, resolved within the adjuster’s authority band, bypasses this queue entirely. Its routing history reflects fewer internal transfers.

Archival Records

Closed claims move into archival storage governed by retention schedules. The document repository for each file lists uploaded materials in chronological order. Some files contain extensive documentation, including supplemental estimates, compliance forms, audit notes, investigation reports, and escalation correspondence. Others contain only intake forms and payment confirmations.

Both collision claims remain indexed under the status code “Closed – Current Quarter” within quarterly reporting tables. Their outward classification aligns in summary views, while underlying records retain distinct routing sequences composed of approval entries, audit flags, compliance annotations, fraud referral markers, and document uploads logged under separate transaction identifiers within the system’s recordkeeping architecture.