Regulatory bulletin is registered within the insurer’s compliance gate, stamped with an effective date two weeks ahead. The document is entered under a revised subsection of claims handling norms and linked to a digital acknowledgment form taking departmental sign- off. Within hours, internal compliance officers attach the bulletin to workflow templates used by property and …

Two automobile collision reports register in the claims platform within the same hour. Each submission contains motorist statements, police report figures, photos of hinder cushion damage, and form estimates formatted in analogous templates. A claims input specialist verifies policy figures against the underwriting database and confirms active content on the reported dates of loss. Claim …

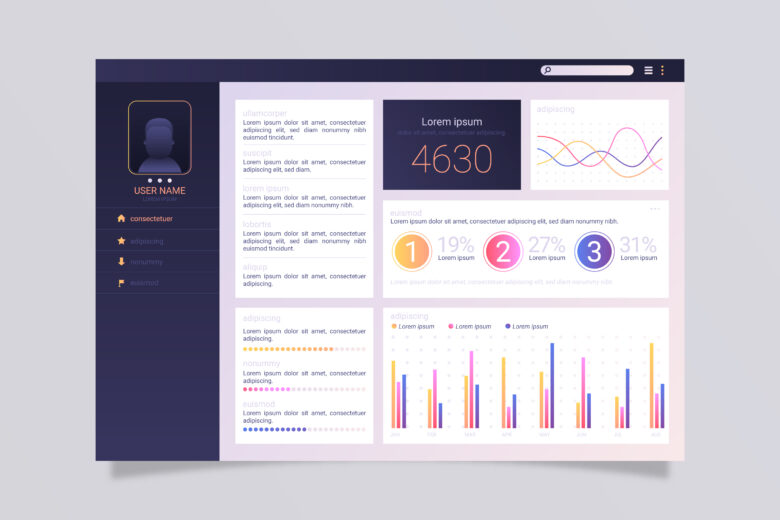

In a regional claims center, authority bands are embedded into the claims management platform. Each adjuster profile contains a settlement ceiling tied to role classification and tenure. The ceiling appears in a side panel beside the reserve amount field. When projected exposure approaches that ceiling, a notification banner activates across the file header. The claim …

Capital is recorded as a set of tolerances instead of actual funds on the claims floor. When a claim is first submitted, a file is created in a system. This file shows policy limits and descriptions of the loss. Any deductibles are already filled in, and coverage codes come from earlier records. The capital related …

Within internal directories, authority is set by numerical ranges tied to job titles. An adjuster’s profile shows a maximum settlement amount based on their experience and licensing. Amounts that go over this maximum need approval. The file isn’t stopped; it’s moved to a different queue. A digital mark shows when it moves from one authority …

In a regional insurance office, a policy from twenty years ago appears in today’s claim system. The fields in the policy do not line up well with the current templates. This coverage form is from before the last system change. Its endorsements were written using an old coding method that used letters and numbers that …

Authority bands appear in internal directories as fixed numerical intervals aligned with job classifications. Settlement ceilings correspond to titles, and titles correspond to reporting lines. In periods of expanded underwriting appetite, certain bands are adjusted upward through configuration changes recorded in administrative logs. The revision carries an effective date and a reference to an internal …

A loss notification is logged into the claims platform through a structured intake form. The representative selects a loss type from a dropdown menu, enters the date of occurrence, and confirms the policy number against a verification field that auto-populates insured details. A claim number generates instantly, appearing at the top of the screen in …

When a policy is created, the underwriting interface stores coverage terms in a structured way. Things like limits, deductibles, and effective dates are put into a policy record, which has its own unique number. Later, the same policy shows up in a different claims system. The information from the policy record is moved over through …

Rate tables start in an underwriting platform. This platform keeps track of base premiums, location costs, and classification codes in set areas. Each time a rate changes, there’s a date it starts being used and a reference number tied to a filing with regulators. The underwriting system saves old rate versions as locked files, which …